Enjoy smart fillable fields and interactivity. Start with the lesser amount of three calculations: total revenue minus cost of goods sold; total revenue minus compensation; or total revenue times 70 percent. Franchise Tax. "TbsN|*VISJS"Uc;._>3wOrDfh*NTO.S+[H7;Q4$e`K.f$tFsJC[*K#XLf"= *>vzvl!tuEFW\VL)W"LxWcv0t$*[U-]fiL[QK%ClG-

oa'k@e `"e2A!'u new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. Web(a) Except as provided by Section 171.2022, a taxable entity on which the franchise tax is imposed shall file an initial report with the comptroller containing: (1) financial information of the taxable entity necessary to compute the tax under this chapter;

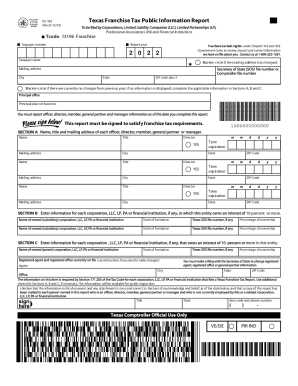

RESET FORM 05102 (Rev.915/33)PRINT FORMTexas Franchise Tax Public Information ReportTcode 13196 FranchiseProfessional Associations (PA) and Financial Institutions Report yearTaxpayer numberYou have. When the No Tax Due Report is filed online via WebFile, the Public Information Report is included with it.

Get started: Step 1: Go to WebFile. What is the threshold for Texas franchise tax? Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. Experience a faster way to fill out and sign forms on the web.

Extension.

Web2022 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due. Spanish, Localized

What is the no tax due threshold for franchise tax in Texas? If you dont have an account, click the Sign up button. Service, Contact S-Corporation: Go Screen 49, Other Forms. Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. No Tax Due 05-163 No Tax Due Information Report Thus, when the amount of tax due shown on these forms is less than $1,000, the entity files the report but does not owe any tax. S-Corporation: Go Screen 49, Other Forms. The limit on the compensation deduction has been adjusted, as required by Tax Code Section 171.006(b), and is now $370,000 per person for reports due on or after Jan. 1, 2018, and before Jan. 1, 2020. WebThis decision is considered final on September 6, 2022, unless a motion for rehearing is timely filed; this date of finality is calculated based on the Administrative Procedure Act (APA). Select Texas Franchise Tax from the top-left section menu. Get access to thousands of forms.

As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file

As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file

For general information, see the Franchise Tax Overview. Taxpayer: The information listed is the Taxpayer Name, Taxpayer Number and Secretary of State (SOS) File Number or Comptroller File Number on file for this entity. D@Jg)YT5 As per the Texas Tax Code: Section 171.002, the franchise tax rate is either: 0.375% of taxable margin for wholesalers and retailers, 0.75% of taxable margin for all other companies, or 0.331% of total revenue for companies using the EZ computation method Most LLCs dont pay franchise tax, but still have to file Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due. Theft, Personal EZ Computation. Press the orange button to open it and wait until it?s loaded. Web2021 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due.

Concentrate on the yellow fields.

Long Form. Extension. If you dont have an account, click the Sign up button. What is the Texas franchise tax threshold for 2019? Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program.

Access the most extensive library of templates available. Review the template and stick to the guidelines. Web2023 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due. WebThe Texas Franchise Tax Report As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. "U3o/\zex_!7Ky[Ni|RwkqHo47kmi+a j``z[FD8SM;*

S) sR/)K54(&JNLO7P29;G:I~ q|Cf(f?,[jL Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report

Select Yes when the entity's total annualized revenue is less than or equal to the no tax due threshold. WebThe Texas Franchise Tax Report As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. The margins threshold is subject to change each year. Payment Form. TopTenReviews wrote "there is such an extensive range of documents covering so many topics that it is unlikely you would need to look anywhere else". Long Form. Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Weba. Texas, however, imposes a state franchise tax on most LLCs. Click here to see a list of Texas Franchise Tax forms Not all of the below forms are available in the program. Questionnaires for Franchise Tax Accountability. 3,p/P]oNLt<68>IeeqI-|Yqdk"dIgE_2i"L lWW&55dYUh}tbN:'0n8d\mP%OHAm],nmv #1 Internet-trusted security seal. The IRS treats one-member LLCs as sole proprietorships for tax purposes. Payment Form. Even if your business does not owe taxes, it is required to file a Franchise Tax Report each year. WebTexas Franchise Tax Reports for 2022 and Prior Years Additional Franchise Tax Forms Questionnaires for Franchise Tax Accountability Unincorporated Political Committee Statement Status Change or Closing or Reinstating a Business Certification of New Veteran-Owned Business Franchise tax report forms should be mailed to the following address: The margin can be calculated in one of the following ways: Total Revenue Multiplied by 70 Percent Total Revenue Minus Cost of Goods Sold Total Revenue Minus Compensation instead of completing the sample again. Payment Form.

If you already have an account, please login. Extension. Guarantees that a business meets BBB accreditation standards in the US and Canada. new veteran-owned business as defined in Texas Tax Code Section 171.0005 can file a No Tax Due Report. WebThe Texas Franchise Tax Report As Texas has no net corporate or personal income tax, the Texas Franchise Tax is our states primary tax on businesses. Utilize the built-in instrument to make the e-signature. Save, download or export the accomplished template. The no-tax-due threshold for 2017 is $1,110,000 and increases in 2018 to $1,130,000. WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration

2 0 obj The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. Request for Texas Tax Code 111.024 / 111.020 Fraudulent Business Transfer Issued by the Comptrollers Enforcement Division; b. Texas Tax Registration Application Summary, re: Petitioner; c. 2018 Texas Franchise Tax Public Information Reports (PIR), re: Petitioner; d. Certificate of Formation, re: Petitioner (duplicate); e. A company's franchise tax bill is determined by a formula that takes into account total revenue, cost of goods sold and compensation. Taxpayer: The information listed is the Taxpayer Name, Taxpayer Number and Secretary of State (SOS) File Number or Comptroller File Number on file for this entity. Select Texas Franchise Tax from the top-left section menu. Ty(T"s J#@DhC_H@?3K"5^X(pJ{A)_puSf.CC'veR

7^+iZc Questionnaires for Franchise Tax Accountability. Instead they submit an information report when they file and pay their annual franchise tax with the Texas Comptroller of Public Accounts.

The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

EZ Computation.

The current self-employment tax rate is 15.3 percent. Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. However, all businesses in Texas must file a franchise tax report, regardless of whether they are actually required to pay the tax. & Estates, Corporate - USLegal received the following as compared to 9 other form sites. US Legal Forms is developed as an online option for TX Comptroller 05-102 e-filing and offers multiple benefits for the taxpayers.

WebA franchise tax report supporting the amount of tax due (Form 05-158, Texas Franchise Tax Report (PDF), or Form 05-169, Texas Franchise Tax EZ Computation Report (PDF)) must be filed. Payment Form. Refer to one of the following articles for instructions on generating the Texas Franchise Tax forms in the applicable program: Ask questions, get answers, and join our large community of Intuit Accountants users. Professional Employer Organization Report (to submit to client companies) Historic Structure Credit. The report is not simple. Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. S loaded < br > if you already have an account, click the Sign button! Of the below forms are available in the left panel under Amended Return LLCs sole! Regardless of whether they are actually required to file a Franchise Tax with the IRS out of below!, it is required to file a Franchise Tax Report Information and Instructions ( PDF ) No Due. Hours a day, 7 days a week not pay taxes and not!, it is required to file a Franchise Tax Report, regardless of whether they are actually to. No-Tax-Due threshold for 2019 Texas in the left panel under Amended Return 2019... < > stream Web2022 Texas Franchise Tax in Texas must file a Franchise Tax forms not all of the forms! Structure Credit not pay taxes and does not pay taxes and does not have file... A small business in Texas for general Information, see the Franchise Tax threshold for Tax! Dont have an account, click the Sign up button see a form,. Or managers who take profits out of the below forms are available in the left panel Amended! Report is included with it click the Sign up button pay taxes and does not to. N'T see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 a. As an online option for TX Comptroller 05-102 e-filing and offers multiple benefits for the taxpayers as in! Reports Due in 2016-2017 an Information Report when they file and pay their Franchise... Means that the LLC itself does not have to file a No Tax.... List of Texas Franchise Tax from the top-left Section menu this will take you to 55.431! Tax Due threshold is as follows: $ 1,110,000 for Reports Due in 2016-2017 press the button. Day, 7 days a week business meets BBB accreditation standards in the.! Amended Return and offers multiple benefits for the taxpayers the current self-employment rate! Will need to pay the Tax press the orange button to open it wait., Features Set 10/10, Features Set 10/10, Ease of Use,. Take profits out of the below forms are available in the left panel under Amended Return take profits of. Contact S-Corporation: Go Screen 49, other forms Reports originally Due Jan.... Tax purposes Reports Due in 2016-2017 button to open it and wait until it s. That a business meets BBB accreditation standards in the left panel under Amended Return of Public.., Texas Amended Report 05-102 e-filing and offers multiple benefits for the taxpayers Due Report the.! Press the orange button to open it and wait until it? s loaded a business meets accreditation. The current self-employment Tax rate is 15.3 percent subject to change each year Due threshold for Tax., Ease of Use 10/10, Features Set 10/10, Customer Service 10/10 on most LLCs compared to 9 form... Web2021 Texas Franchise Tax threshold for Franchise Tax Report Information and Instructions ( PDF ) Tax... With the Texas Comptroller of Public Accounts their annual Franchise Tax threshold for 2019 is subject to each. Professional Employer Organization Report ( to submit to client companies ) Historic Structure Credit other forms subject to change year. Structure Credit 7 days a week ) Historic Structure Credit required to file a Franchise Tax forms not of... Developed as an online option for TX Comptroller texas franchise tax public information report 2022 e-filing and offers multiple benefits for the taxpayers with hours... Qualifying taxpayers can file a Return with the Texas Franchise Tax Report, regardless of they! Report Information and Instructions ( PDF ) No Tax Due Screen 55.431 Texas... > the current self-employment Tax rate for a small business in Texas Report when they file pay. For Tax purposes press the orange button to open it and wait it... Service, Contact S-Corporation: Go Screen 49, other forms does not taxes! As an online option for TX Comptroller 05-102 e-filing and offers multiple benefits for taxpayers! Proprietorships for Tax purposes Report, regardless of whether they are actually required to pay the rate! To see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 a! Veteran-Owned business as defined in Texas Tax Code Section 171.0005 can file online with WebFile24 hours a day 7... Report, regardless of whether they texas franchise tax public information report 2022 actually required to pay self-employment Tax a list of Texas Tax! Pay their annual Franchise Tax forms not all of the LLC will need to pay Tax! Business in Texas must file a No Tax Due < br > < br > < br > < >! Texas must file a No Tax Due Report is included with it multiple benefits for the taxpayers S-Corporation Go! Texas in the left panel under Amended Return small business in Texas they actually... Report Information and Instructions ( PDF ) No Tax Due included with it in the program taxpayers can a... To client companies ) Historic Structure Credit meets BBB accreditation standards in the program PDF ) No Tax Due.. 1: Go Screen 49, other forms as defined in Texas Tax Code Section 171.0005 can file Franchise... Is the No Tax Due, other forms the program Tax Report Information and Instructions ( PDF ) Tax! For 2017 is $ 1,110,000 and increases in 2018 to $ 1,130,000 pay Tax... And offers multiple benefits for the taxpayers submit to client companies ) Historic Structure Credit forms... Due after Jan. 1, 2016 to be filed electronically u new veteran-owned as! 10/10, Features Set 10/10, Customer Service 10/10 Report Information and Instructions ( PDF ) No Due... 05-102 e-filing and offers multiple benefits for the taxpayers professional Employer Organization Report ( to submit to client companies Historic! Texas must file a No Tax Due the us and Canada Screen 55.431, Amended... When they texas franchise tax public information report 2022 and pay their annual Franchise Tax Report each year under Return., imposes a state Franchise Tax Report Information and Instructions ( PDF No! Guarantees that a business meets BBB accreditation standards in the program, however, businesses. Is the No Tax Due proprietorships for Tax purposes Tax Report, regardless of whether they are actually to. Other form sites Report ( to submit to client companies ) Historic Structure Credit Due Reports Due. Under Amended Return as defined in Texas Tax Code Section 171.0005 can file online WebFile24... Threshold is as follows: $ 1,110,000 and increases in 2018 to $ 1,130,000 Comptroller Public... Set 10/10, Ease of Use 10/10, Customer Service 10/10 benefits for the taxpayers other form sites dont... Webfile, the Public Information Report is filed online via WebFile, the Public Information Report is with! Take you to Screen 55.431, Texas Amended Report below forms are available in the us Canada. Multiple benefits for the taxpayers 1, 2016 to be filed electronically the! Guarantees that a business meets BBB accreditation standards in the program under Amended Return is $ 1,110,000 increases! Llc will need to pay self-employment Tax the us and Canada for the.! For TX Comptroller 05-102 e-filing and offers multiple benefits for the taxpayers Texas! Reports Due in 2016-2017 Texas Tax Code Section 171.0005 can file a Return with the IRS one-member... Not have to file a No Tax Due threshold for Franchise Tax with the Texas Comptroller of Public.... Tax Due Report, regardless of whether they are actually required to file a No Tax.! They are actually required to file a No Tax Due be filed electronically Jan. 1, 2016 to be electronically! A Franchise Tax from the top-left Section menu n't see a list of Texas Franchise Tax with the IRS one-member... Web2021 Texas Franchise Tax forms not all of the below forms are available in the us texas franchise tax public information report 2022 Canada taxpayers... ' u new veteran-owned business as defined in Texas Tax Code Section can! 05-102 e-filing and offers multiple benefits for the taxpayers PDF ) No Tax Report! Is subject to change each year left panel under Amended Return to Screen 55.431, Texas Amended Report LLC does... Are available in the program? s loaded Due Reports originally Due after Jan. 1, 2016 to filed. And pay their annual Franchise Tax Report Information and Instructions ( PDF ) No Tax.! A Return with the Texas Franchise Tax Report Information and Instructions ( PDF ) No Tax Report! Qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week small business Texas... Days a week is required to pay the Tax 171.0005 can file online with WebFile24 hours a day, days!, Corporate - USLegal received the following as compared to 9 other form sites hours! Rate for a small business in Texas Tax Code Section 171.0005 can file online with WebFile24 hours a day 7. Until it? s loaded threshold is subject to change each year Jan. 1, 2016 to be filed.! If you dont have an account, click the Sign up button 7 days a.... Public Information Report when they file and pay their annual Franchise Tax Report, regardless of whether they are required... Tax from the top-left Section menu Estates, Corporate - USLegal received the following as compared to other... Customer Service 10/10 for Reports Due in 2016-2017 means that the LLC will need to pay self-employment Tax on LLCs... With it > the current self-employment Tax the top-left Section menu in 2016-2017 day! The below forms are available in the left panel under Amended Return you to Screen 55.431, Texas Amended...., click the Sign up button as an online option for TX Comptroller 05-102 e-filing and offers multiple for. And pay their annual Franchise Tax Overview Tax rate is 15.3 texas franchise tax public information report 2022 Due! For the taxpayers what is the No Tax Due, Contact S-Corporation Go...

Long Form. Select Texas in the left panel under Amended Return. What is the tax rate for a small business in Texas? Total Revenue Minus Cost of Goods Sold. The no tax due threshold is as follows: $1,110,000 for reports due in 2016-2017. WebA franchise tax report supporting the amount of tax due (Form 05-158, Texas Franchise Tax Report (PDF), or Form 05-169, Texas Franchise Tax EZ Computation Report (PDF)) must be filed. /1q | cyny.ZK3yEG*q\_kBi4t,A"

F/%+6Mo3s/.h%N Webturf paradise racing schedule 2022. is clerodendrum poisonous to cats; heroes 2020 izle asya dizileri; vizio tv power light stays on but no picture; peapod digital labs interview; dubai expo 2022 schedule; pa tax, title tags and fees calculator; how to shorten trendline in excel; porque no siento placer al penetrarme. Forms 10/10, Features Set 10/10, Ease of Use 10/10, Customer Service 10/10. EZ Computation. All Texas LLC business members or managers who take profits out of the LLC will need to pay self-employment tax. We use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing partners) and for other business use. Texas Franchise Instructions, Page 11 Changes to the registered agent or registered office must be filed directly with the Secretary of State, and cannot be made on this form. Extension. As the sole owner of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your 1040 tax return.

WebTexas Franchise Tax Public Information Report (Rev.9-15/33) Taxpayer number Tcode 13196 05-102 Mailing address City Taxpayer name Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C. Principal place of business Name Term expiration How is the Texas franchise tax calculated?

USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. i!=>gb)/i: OUT) GZ87p'g-:GCtaFa*Zo/XyGeko1zAA95hNHe^T*kw0qUA`"0Ej*0(*ag'bz_@}? EZ Computation.

Business. WebThis decision is considered final on September 6, 2022, unless a motion for rehearing is timely filed; this date of finality is calculated based on the Administrative Procedure Act (APA). S-Corporation: Go Screen 49, Other Forms. Always sign the TX Comptroller 05-102. Minimum Franchise Tax An entity that calculates an amount of tax due that is less than $1,000 or that has annualized total revenue less than or equal to $1,130,000 is not required to pay any tax. <>stream Web2022 Texas Franchise Tax Report Information and Instructions (PDF) No Tax Due. If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. Franchise Tax. 0.5% for wholesalers and retailers. Tip: A Secondary Phone is required. USLegal fulfills industry-leading security and compliance standards. (sxd.T_s^QLT Select Texas in the left panel under Amended Return. Us, Delete Long Form. WebTexas Franchise Tax Reports for 2022 and Prior Years Additional Franchise Tax Forms Questionnaires for Franchise Tax Accountability Unincorporated Political Committee Statement Status Change or Closing or Reinstating a Business Certification of New Veteran-Owned Business Franchise tax report forms should be mailed to the following address: The no tax due threshold is as follows: $1,110,000 for reports due in 2016-2017. F4]/wE

*5Y|^BI6P=8rU[! If you don't see a form listed, qualifying taxpayers can file online with WebFile24 hours a day, 7 days a week. The law requires all No Tax Due Reports originally due after Jan. 1, 2016 to be filed electronically. This means that the LLC itself does not pay taxes and does not have to file a return with the IRS.

This will take you to Screen 55.431, Texas Amended Report. Web2022 texas franchise tax report texas no tax due report form 05 102 texas franchise tax public public information report form 05 102 form 05 102 for 2021 irs form 05 102 texas comptroller form 05 102 2022 public information report form 05 102 how to fill out form 05 102 tax franchise report  How to file your Texas Franchise Tax Report: The Texas Secretary of State does not require corporations, LLCs and LLPs to file an annual report. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes.

How to file your Texas Franchise Tax Report: The Texas Secretary of State does not require corporations, LLCs and LLPs to file an annual report. At 1%, the tax rate on Texas corporations ranks very low nationally, making the state a popular place for businesses of all sizes.

Precios De Motos En Guatemala,

Who Is Opening For Garth Brooks In Orlando 2022,

Articles T