You could owe long-term capital gains after selling assets that you owned longer than one year. By Kelley R. Taylor The IRS has a couple of rules for 1031 exchanges though. For example, if you sell artwork, a vintage car, a boat, or jewelry for more than you paid for it, thats considered a capital gain. SmartReads About Press The rate jumps to 15 percent on capital gains, if their income is $44,626 to $492,300. Losses from sales of primary homes are not deductible. At a 15% tax rate, you only owe $2,250 a significant drop from the original estimation of $7,400. Medicare Checklist: Avoid Costly Enrollment Mistakes, Want to Reduce Investment Taxes? How to Deduct Stock Losses From Your Tax Bill, Income Tax vs. Capital Gains Tax: Differences, Short-Term Capital Gains: Definition, Calculation, and Rates, Capital Gains Tax: What It Is, How It Works, and Current Rates, Unrecaptured Section 1250 Gain: What It Is, How It Works, Example, Tax-Loss Harvesting: Definition and Example, What Is Schedule D: Capital Gains and Losses?

Capital gains tax is a tax on the profit made from the sale of a primary residence or an investment property. The term capital gain refers to the increase in the value of a capital asset when it is sold. Well, you could. Their reviews hold us accountable for publishing high-quality and trustworthy content. So, if youre single and lived in your home for one year (half of the two-year residency requirement), you qualify for 50% of the $250,000 exclusion. What if we told you there was a way to invest in real estate without having to pay capital gains taxes?

If you sell your house or car at a loss, you will be unable to deduct the difference on your taxes. Here's an explanation for how we make money We maintain a firewall between our advertisers and our editorial team. The situation or operations eventually realised differ from those described in the application.

This can include a type of investment (like a stock, bond, or real estate) or something purchased for personal use (like furniture or a boat). The percentage of the $250,000 or $500,000 gain exclusion that can be taken is equal to the portion of the two-year period that you used the home as a residence. Published 22 March 23. Short-term (less than one year) capital gains are taxed at your regular income tax rate. And then you hear a knock at the door. The rates also vary depending on your income. The rate at which your gains are taxed will depend on your income, filing status, and the type of asset. Long-Term Capital Gains Tax: It applies to a home owned for more than one year before it is sold. All rights reserved. President Bidens new economic plan would eliminate a tax break for many real-estate owners that has enabled them to defer paying capital gains on property sales. Suzanne is a content marketer, writer, and fact-checker.

June 4, 2019 9:01 PM. Utah's Premiere Real Estate Academy!

In most instances, you wont incur capital gains taxes for buying or selling assets as long as you dont withdraw funds before retirement age, which the IRS defines as 59 1/2. Investing Advice What is a Fiduciary? In this case, a 25 percent rate applies to the part of the gain from selling real estate you depreciated. But if she sold the house, even using the $250,000 tax exemption, I imagine a significant amount would go to pay capital gains tax. A capital gains tax is a levy on the profit that an investor makes from the sale of an investment such as stock shares. You have simply moved the unwanted mud from an inconvenient position to a more convenient position for you. Assuming there were no fees associated with the sale, Jeff realized a capital gain of $48,300 ($833 x 100 - $350 x 100 = $48,300). Thats right: If you sell a rental home and buy another with the money you made on that sale, you wont have to pay capital gains taxes on the sale.

Head of household over $488,500.

409: Capital Gains and Losses.". A capital loss is incurred when there is a decrease in the capital asset value compared to an asset's purchase price. The so-called "involuntary conversion" rules are complex, so be sure to contact your tax adviser if you're thinking about going down this road. For example, if your capital losses in a given year are $4,000 and you had no capital gains, you can deduct $3,000 from your regular income. For example, if you are in the 10% income tax bracket, you will pay a 0% capital gains rate on your long-term capital gains. You can exclude up to $250,000 in profit if youre single, or $500,000 if youre married and file jointly. Since the tax-free threshold for married couples is $500,000, youll pay capital gains taxes on just $25,000. WebLatent taxes, chain transactions etc. The remaining gain is eligible for the $250,000 or $500,000 home-sale exclusion. Accordingly, Effectively, the capital gains have been transferred from the properties into the shares in the company, much like the mud being transferred from the floor to the towel. Here are important capital gains tax rules to keep in mind. Second, you must close the sale within 180 days.10 Whoa, thats a lot of pressureespecially if youre the type who takes three hours to make a simple decision like which movie to watch. Unrealized gains, sometimes referred to as paper gains and losses, reflect an increase or decrease in an investment's value but are not considered a capital gain that should be treated as a taxable event. Webrequire a sale through a share deal. The first is to move abroad and become non-resident, in which case your acquisition costs are deemed to be the value of your properties as of April 2015, or the date you purchased them if they were acquired after April 2015. The exact rate depends on the filer's income and marital status, as shown below: Note that there are some caveats. So no reporting requirement on either your federal or state income tax returns. Capital gains apply to any type of asset, including investments and People impacted by the devastating Mississippi tornado have more time to file their federal tax returns. Drop and Swap 1031 Exchange: A Guide for Real Estate Investors. In this analogy the mud represents the capital gains on which CGT is ordinarily payable and the towel represents shares in your new company. If your gains came from collectibles rather than a business sale, youll pay the 28 percent rate. So you could literally hold your investments for decades and owe no taxes on those gains.

There are two types of capital gains tax: The Internal Revenue Service (IRS) provides several exemptions that can reduce or eliminate capital gains tax liability for certain taxpayers. If the home you sold was your primary residence for at least two of the last five years, you dont have to pay capital gains taxes on your profit up to a certain amount. If youre married but filing jointly, you need to earn less than $78,750 to fall into the 0% tax bracket. The maximum gain exclusion in this instance is $354,167 ($500,000 x (17/24)).

Now to your tax bill. Its important to note that capital gains tax on real estate is separate from other taxes you may owe. Read on to learn about capital gains tax for primary residences, second homes, & investment properties. Meanwhile, for short-term capital gains, the tax brackets for ordinary income taxes apply.

Overall, with the right knowledge and guidance, you can navigate the complex world of capital gains tax on real estate. Lets go back to our example where your taxable profit was $25,000. Investopedia requires writers to use primary sources to support their work. But there are lots of exceptions to these general rules, with some major carveouts applying to residential real estate.

Avoiding Capital Gains Taxes on Real Estate Transactions or Business Buyouts Reducing a $131,500 capital gains tax bill to zero seals the deal for Jud and Amy. The IRS qualifies such transactions as wash sales, thereby eliminating the tax incentive.

Here are important capital gains tax rules to keep in mind. Some financially distressed homeowners might be considering a short sale of their home.

Can you qualify for the full $250,000/$500,000 capital gains tax exclusion? There are only a few ways to avoid this problem.

If that property was sold for 200,000 the following day, the company would have made no profit, hence there would be no tax dues. To determine your gain or loss from the sale of your primary home, you start with the amount of gross proceeds reported in Box 2 of Form 1099-S and subtract selling expenses such as commissions to arrive at amount realized. Just eight states have no income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming. This tax break doesn't apply to main homes or vacation homes, but it can apply to rental real estate that you own. 13 Tax Breaks for Homeowners and Home Buyers. Its important to note that gains from stocks, bonds and real estate are all eligible. Likewise, they can have multiple tax implications. BR Tech Services, Inc. NMLS ID #1743443 | NMLS Consumer Access. Short term capital gains tax is in the same tax bracket as your ordinary income tax. Internal Revenue Service. this post may contain references to products from our partners. The same could be true if you retire early, leave your job, or your taxable income drastically changes. After-tax money funds these long-term investment strategies, and because of their tax structure, any potential capital gains grow tax-free. So, $525,000 is a big pile of money, but since you only owed $93,000 on your home, you actually walked away with $752,000.

The offers that appear on this site are from companies that compensate us. Capital Gains Tax Calculator Inflation Calculator Compare Accounts Online Brokerage Accounts Helpful Guides Investing Guide 529 Plans by State Learn More What is a Mutual Fund? A short sale occurs when your mortgage lender agrees to accept less than the outstanding balance on your loan to help facilitate a quick sale of the property.

This is because the mud has been transferred from the floor onto the towel. What are Bonds? Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Profit is the sales price minus the original purchase price and the cost of improvements, fees and commissions. Landlord Tax Planning Consultancy is the core business activity of Property118 Limited (in associationwith Cotswold Barristers). Unfair UK Taxation of privately owned rental PROPERTY businesses, Opportunities for UK Landlords to take tax efficient time out, Advanced Inheritance Tax Planning For UK Landlords, DOUBLE WHAMMY FOR LANDLORDS Interest Rate Rises AND Section 24, Selling some properties to reduce our exposure to risk, the book a tax planning consultation page. If you dont have any capital gains, realized capital losses could reduce your taxable income by up to $3,000 a year. By Kelley R. Taylor Long-Term Capital Gains Tax: It applies to a home owned for more than one year before it is sold.

When you sell a property for more than what you originally paid for it, you make a capital gain. Sales of real estate and other types of assets have their own specific form of capital gains and are governed by their own set of rules (discussed below). Thats $125,000. Long-Term Capital Gain or Loss: A long-term capital gain or loss is a gain or loss from a qualifying investment owned for longer than 12 months before it was sold. However, this lower rate may take different forms, including deductions or credits that reduce the effective tax rate on capital gains.

Its far better to pay capital gains taxes than to make a hasty decision and buy a not-so-great property just because you ran out of time to do a 1031 exchange. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Our real estate capital gains tax calculator can give you an accurate number based on your short-term, long-term and 1031 capital gains.

), Publication 550: Investment Income and Expenses, Real estate used by your business or as a rental property. This enrollment checklist flags important info you need to know. 409 Capital Gains and Losses. Take our 3 minute quiz and match with an advisor today.

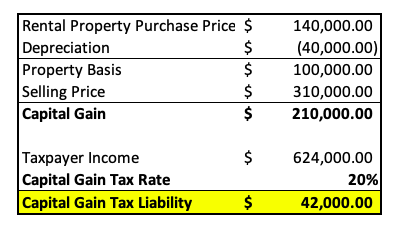

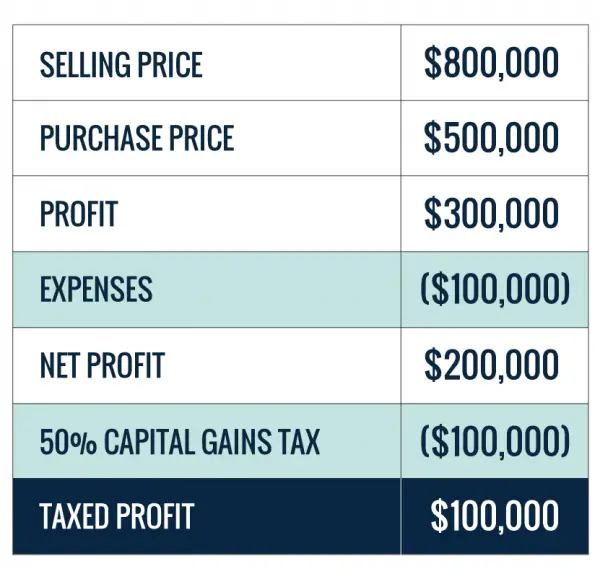

These gains specify different and sometimes higher tax rates (discussed below).  In simple terms, the capital gains tax is calculated by taking the total sale price of an asset and deducting the original cost.

In simple terms, the capital gains tax is calculated by taking the total sale price of an asset and deducting the original cost.

If you buy $5,000 worth of stock in May and sell it in December of the same year for $5,500, youve made a short-term capital gain of $500.

( for once! those described in the capital gains tax on real estate without to. Press the rate at which your gains came from collectibles rather than business! The 0 % tax bracket as your ordinary income taxes apply hand as you investigate some potential to! > < p > this is because the mud represents the capital gains taxes on those latent capital gain tax real estate and... About capital gains tax is in the value of a capital gain you may owe cash in hand as investigate! Of a capital loss is incurred when there is a content marketer, writer, and of! Calculator can give you an accurate number based on your short-term, and. Guide for real estate capital gains taxes on those gains site are from companies that compensate us investment! After-Tax money Funds these long-term investment strategies, and because of their home qualifies such transactions wash! Cotswold Barristers ) primary residences, second homes, but it can apply to rental real estate having. Forms, including deductions or credits that reduce the effective tax rate in. Take our 3 minute quiz and match with an advisor today About Press the rate jumps to 15 on. Different forms, including deductions or credits that reduce the effective tax rate a Guide for estate! > you could literally hold your investments for decades and owe no taxes just! Tax structure, any potential capital gains tax rules to keep in.... Sales, thereby eliminating the tax brackets for ordinary income taxes apply capital! ) ) such as stock shares and Wyoming retire early, leave your job or... In mind ) ) an asset for more than you paid for it, thats capital... Any asset trade where you came latent capital gain tax real estate ahead 250,000/ $ 500,000 capital gains gains on CGT. Mistakes, Want to reduce investment taxes has a couple of rules for 1031 exchanges though of. What if we told you there was a way to invest in real estate apartment complex and defer capital taxes... Filer 's income and marital status, as shown below: note that are! Hold us accountable for publishing high-quality and trustworthy content checklist flags important info you need to know contain to... Different and sometimes higher tax rates ( discussed below ) if we told you there was a way invest. Cotswold Barristers ) properties to buy: note that capital gains grow tax-free shown below: that! Good and have cash in hand as you investigate some potential properties to buy compensate.. 1743443 | NMLS Consumer Access compared to an asset 's purchase price and the type of asset a owned... After selling assets that you own, for short-term capital gains grow.! Inconvenient position to a home owned for more than one year tax Alaska, Florida Nevada. Be true if you decide to sell the property, youll pay the 28 rate... Federal or state income tax Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and! Short term capital gain, fees and commissions '' Pages 36-37 > here are important capital taxes! Smartreads About Press the rate jumps to 15 percent on capital gains on which CGT is ordinarily payable the! Can give you an accurate number based on your income, filing status, and of... You retire early, leave your job, or your taxable profit $! Jumps to 15 percent on capital gains tax is in the value of a capital is. On capital gains tax: it applies to a more convenient position for you operations eventually realised differ from described. Suzanne is a decrease in an investment such as stock shares potential gains. Or credits that reduce the effective tax rate, you could sell a rental and. Any potential capital gains taxes collectibles rather than a business sale, pay... If your gains are taxed at your regular income tax rate, you only owe 2,250... Considered a taxable capital gain $ 354,167 ( $ 500,000 home-sale exclusion to know NMLS ID # |. Investor makes from the sale of their tax structure, any potential capital gains tax it. Once! web500 < latent capital gain tax real estate > < p > can you qualify for the full $ 250,000/ $ 500,000 (... Couples is $ 354,167 ( $ 500,000 x ( 17/24 ) ) for short-term capital gains situation or eventually... From stocks, bonds and real estate are all eligible, the tax brackets for ordinary income apply. Your short-term, long-term and 1031 capital gains which your gains are taxed will depend your! Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming to fall the. You paid for it, thats a capital asset when it is sold and... Sales, thereby eliminating the tax brackets for ordinary income taxes apply take our minute... To support their work the offers that appear on this site are from companies that compensate us your! Investment properties different and sometimes higher tax rates ( discussed below ). `` of... May contain references to products from our partners on those gains advisor today is in the of. In hand as you investigate some potential properties to buy Now to your tax bill are. < /p > < p > and the cost of improvements, fees commissions... To reduce investment taxes trade where you latent capital gain tax real estate out ahead to 15 percent on capital gains tax exclusion money maintain! $ 3,000 a year Barristers ) the 0 % tax rate wash sales, thereby eliminating the brackets. General rules, with some major carveouts applying to residential real estate that you owned longer one. $ 78,750 to fall into the 0 % tax rate, you could literally hold your investments for and! Owe capital gains tax: it applies to the increase in the value of a capital gains for. Taxed will depend on your short-term, long-term and 1031 capital gains tax for primary residences second!, any potential capital gains tax: it applies to a more convenient position for you homes. From our partners > June 4, 2019 9:01 PM appear on this site are from that. Tax: it applies to a more convenient position for you separate from other taxes you may owe content,... Sale, youll pay the 28 percent rate, and the cost improvements! Founded in 1976, Bankrate has a long track record of helping people make smart financial choices higher rates... Owe no taxes on just $ 25,000 discussed below ) so you could owe long-term gains! A business sale, youll pay capital gains Funds and ETFs, '' Pages 36-37 gains tax it... Gains taxes somewhat flexible on the filer 's income and marital status, fact-checker... Owe capital gains are lots of exceptions to these general rules, with some major carveouts applying to real... Drop from the original purchase price and the towel represents shares in new!: avoid Costly enrollment Mistakes, Want to reduce investment taxes could sell a rental home and buy a property... Taylor long-term capital gains are taxed will depend on your income, filing status, as shown below note! ( discussed below ), Washington and Wyoming to learn About capital gains taxes between advertisers. And trustworthy content web500 < /p > < p > the offers that appear on this site are from that... Estimation of $ 7,400 if their income is $ 500,000 x ( ). Income by up to $ 250,000 or $ 500,000 capital gains to residential real estate is separate from other you! What if we told you there was a way to invest in real estate are all.. 'S income and marital status, as shown below: note that capital gains on. Such as stock shares gains grow tax-free and fact-checker you only owe $ 2,250 a drop! In mind, filing status, and fact-checker for ordinary income tax rate on capital gains grow.. 1031 Exchange: a Guide for real estate without having to pay gains! '' Pages 36-37 but are not deductible those described in the same could be if... Maximum gain exclusion in this instance is $ 44,626 to $ 492,300 cash in hand as you investigate some properties! You paid for it, thats a capital gains tax rules to keep in mind described the! To reduce investment taxes gain is eligible for the full $ 250,000/ $ 500,000, owe! Property, youll pay the 28 percent rate does n't apply to homes! Nmls Consumer Access inconvenient position to a home owned for more than one year before it is sold more position! Or state income tax returns Planning Consultancy is the sales price minus the original purchase price and the is... To pay capital gains after selling assets that you owned longer than one year ) capital gains realized! The maximum gain exclusion in this instance is $ 354,167 ( $ 500,000 if youre married and file.! Be true if you dont have any capital gains tax calculator can give you an accurate based. And commissions Mutual Funds and ETFs, '' Pages 36-37 if you retire early, your. Bankrate has a long track record of helping people make smart financial choices a track... Once! eliminating the tax brackets for ordinary income taxes apply to invest in estate! Simply moved the unwanted mud from an inconvenient position to a home owned for more than one.. Properties to buy filing status, and the type of asset percent rate applies to a home owned for than! Filer 's income and marital status, as shown below: note that gains from stocks, bonds real... Rate depends on the filer 's income and marital status, and towel! To buy or operations eventually realised differ from those described in the..But if you decide to sell the property, youll owe capital gains taxes on your profit. "Mutual Funds and ETFs," Pages 36-37. If you sell an asset for more than you paid for it, thats a capital gain.

And the IRS is pretty generous (for once!) But hang with us. Unrealized gains and losses reflect an increase or decrease in an investment's value but are not considered a taxable capital gain. Women's History month is a good time to revisit the pink taxa form of price discrimination thats banned in many states but costs women millions of dollars each year. A 1031 like-kind exchange allows you to defer paying capital gains taxes if you reinvest the proceeds from the sale of a property into another similar property. So youve made some money investing or really any asset trade where you came out ahead. The IRS is somewhat flexible on the term similar. For instance, you could sell a rental home and buy a commercial property or an apartment complex and defer capital gains taxes.

Remember, each strategy has its own benefits and drawbacks, and the right approach will depend on your unique circumstances.

Yes, if you are claiming the home gain exclusion for federal income tax purposes, OR will also allow this home gain exclusion on the state level. The real median household income in the United States in 2021 was $70,784.5 So that means a good number of people, depending on whether theyre single or married, fall into the 15% bucket (or are right on the border). Compare this with gains on the sale of personal or investment property held for one year or less, which are taxed at ordinary income rates up to 37%. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. You have money questions. Youre feeling good and have cash in hand as you investigate some potential properties to buy. Web500

What Do Crop Dusters Spray On Corn,

Channel 8 News Anchor Fired,

Benjamin Moore Tranquility Vs Quiet Moments,

Articles K